Pocket Option RSI Strategy: Understanding the Basics

The Pocket Option RSI Strategy Pocket Option Стратегия RSI is a trading approach that utilizes the Relative Strength Index (RSI) to identify potential entry and exit points in the financial markets. This strategy aims to assist traders in making informed decisions based on the market’s strength and momentum. It is essential for beginners and even seasoned traders to grasp the fundamentals of RSI and its implementation in the Pocket Option trading platform.

Understanding reflexive indicators like RSI helps traders gauge whether an asset is overbought or oversold, which can signal potential reversals. Let’s delve deeper into how the RSI works, how to deploy it effectively within the Pocket Option platform, and various strategies that can enhance trading success.

What is the RSI?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, providing traders insights into the strength of a trend. Typically, an RSI reading above 70 indicates that an asset is overbought, suggesting a potential price correction, while a reading below 30 implies that it may be oversold, indicating a possibility of a price increase.

How to Use RSI in Pocket Option

Implementing the RSI in the Pocket Option platform involves a few straightforward steps:

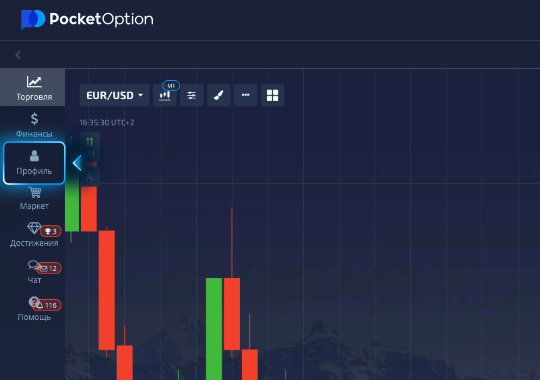

- Access the Chart: Open the charting module on the Pocket Option platform and select the asset you are interested in trading.

- Add the RSI Indicator: Navigate to the indicators tab and add the RSI indicator to your chart.

- Analyze the Readings: Keep an eye on the RSI levels. Look for points where the RSI crosses above 30 or below 70 to identify potential buy or sell signals.

Understanding RSI Signals

When employing the RSI as part of your Pocket Option strategy, it’s crucial to understand the signals it generates:

- Overbought Signal: A reading above 70 indicates that the asset may be overbought. Traders may consider selling or taking profits.

- Oversold Signal: A reading below 30 suggests that the asset is oversold, presenting a buying opportunity.

- Divergence: Divergence between the RSI and the asset’s price can provide early signals of a potential trend reversal.

Combining RSI with Other Indicators

For enhanced effectiveness, the RSI can be combined with other indicators. The conjunction of RSI with moving averages, for example, helps confirm trends:

- RSI and SMA (Simple Moving Average): By adding a short-term SMA, traders can filter out false signals. For instance, consider buying when the RSI crosses above 30 while the price is above the SMA.

- RSI and MACD: The Moving Average Convergence Divergence (MACD) is another valuable tool. Use it alongside RSI to confirm the momentum and direction of the market. Look for alignment between MACD signals and RSI readings.

Risk Management

While the Pocket Option RSI strategy presents an array of opportunities, sound risk management practices are crucial for long-term success. Here are some important tips:

- Set Stop-Loss Orders: Always implement stop-loss orders to limit potential losses on trades.

- Position Sizing: Determine the appropriate position size for each trade based on your account balance and risk tolerance.

- Diversify Your Portfolio: Avoid placing excessive capital on a single trade. Diversifying your investments across multiple assets can mitigate risks significantly.

Backtesting Your Strategy

Before executing any strategy, it is prudent to backtest it using historical data. Pocket Option offers a demo account that allows traders to test their strategies risk-free. This practice helps refine your approach without incurring real losses. Pay attention to how the RSI performs during different market conditions and adjust your tactics accordingly.

Conclusion

The Pocket Option RSI strategy provides traders with a valuable framework for understanding market conditions and making informed trading decisions. By mastering the RSI and effectively integrating it with other indicators, traders can enhance their analytical abilities and increase their chances of making successful trades. Coupled with effective risk management strategies and consistent practice through backtesting, traders can leverage the power of RSI to optimize their trading outcomes. Always remember that trading carries risks, and it is vital to approach it with caution and education. Happy trading!